Reliance on Debt

Societal / Consumer behaviour towards the use of debt and access to credit has changed; influenced by technology, easier lending practices, low interest rates and the extensive media messages to buy now. It has come to the point where over indebtedness is now a substantial issue whether from the perspective of increased family stress over finances or macro concerns for the economy and its stability.

Changing societal behaviour that may create harm is a challenge and requires substantial investments by governments. Examples where governments finally determined that societal behavior needed to be altered for the pubic good at large includes the use of seat belts, reducing smoking and eliminating drinking and driving. Eventually each of these societal changes started first with extensive public education of the dangers, but eventually ended with new laws, regulations and penalties. The campaigns focused on both the public but also the supporting businesses that also needed to change.

I raise the question; Should government play a more aggressive role to address the potential harm over indebtedness? For consumers today, they are placing themselves in a very vulnerable position, a simple change in interest rates of 2 to 3 percent could create a huge wave of insolvencies by doubling of mortgage payments; perhaps a wave of insolvencies like we experienced in 2008-2011.

Impact

Having been the Superintendent of Bankruptcy during the financial crisis, it perhaps was the first time the middleclass was significantly impacted and had to face the reality of insolvency, losing their homes, their cars, company pension plans, etc. The insolvency system is not kind. It is based primarily on recovering funds for creditors, creditors who may have been irresponsible in the first place in terms of providing excessive debt / credit facilities. During the peak of the crises, the number of consumer insolvencies doubled to more than 10,000 people a month. Many of the insolvent consumers had families and as the regulator, we received pleas from families asking that they be protected from foreclosures of their homes, seizures of precious assets; the middleclass experienced the hard reality of the insolvency system; it does not bend to such pleas.

Since the crisis, consumer debt has again increased.

The economy and its growth have become addicted to consumer spending which has in turn been fueled in large part by debt. There has been limited desire by policymakers to tackle the issue of over indebtedness by restricting who can lend or provide credit, let alone put in place regulations for responsible market conduct.

The credit sector does not focus on the number of consumer defaults or “financial casualties” as long as delinquencies stay within the acceptable level defined by their risk and profit modeling. Even then, a simple adjustment of the proposed interest rate and fees can compensate thus maintaining high profitability despite the number of anticipated financial casualties /defaults. This concept of unfettered capitalism has accepted no responsibility as to the costs of the collateral damage on debtors that were enticed into maximum debt; nor have shoulder the societal cost of dealing with these casualties.

An interesting, but perhaps invasive approach was taken in South Africa many years ago setting up a Commission that was given power to address irresponsible lending and over indebtedness with powers to alter credit agreements, reduce interest rates and apply penalties. (National Credit Act 34 of 2005, https://www.gov.za/documents/national-credit-act# )

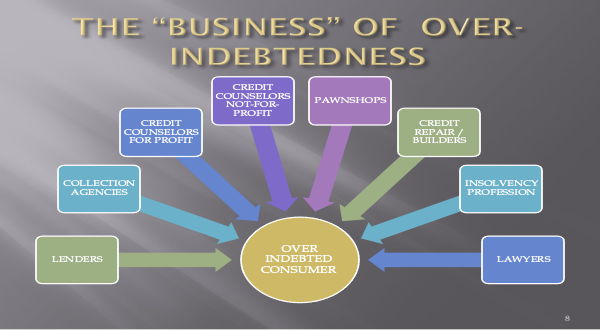

The Growth Business of Over Indebtedness:

Over indebtedness has in itself become big business; it has become a profitable sector of the economy.

The costs of over indebtedness are immense when you consider the fees, charges, and / or profits associated with the above businesses and support services; but we also must consider the costs of the government oversight and regulation on collection practices, the costs of social agencies dealing with family stress /divorce, the burden on the services of courts and the emotional costs on the debtors and their families involved.