“The simplest definition of Financial Consumer Protection is that it includes any activity, action or set of rules that seek to prevent / mitigate financial market place risk(s) and the potential harm to the consumer related to the purchase and use of any financial product or service, or to the customer relationship with Financial Service Providers.”

James Callon – Callon Consulting Inc.

Mr. Callon is a senior regulatory expert with over 40 years of experience in Canada and internationally. He provides advice and counsel on risk based regulatory management, and frameworks with a focus on market conduct, consumer protection and insolvency matters in the financial sector.

He began his career in retail banking with a major Canadian Bank and subsequently pursued an extensive career in regulatory and quasi-judicial organizations in Canadian provincial and federal jurisdictions. Mr. James Callon has worked international for the past eight years following several years of senior executive and Cabinet/Ministerial appointments in Canadian regulatory agencies.

STRENGTHENING CONSUMER CONFIDENCE

IN THE FINANCIAL SECTOR

Mr Callon will assist clients with assessing:

- adequacy of regulatory agency management and regulatory oversight in the market place;

- the adequacy of market conduct and consumer protection measures;

- potential areas of market misconduct, risks and harm by financial services providers;

- the quality of an institution’s culture of compliance;

- the effectiveness of Board and management culture, controls and oversight over retail operations.

ASSISTING POLICY MAKERS AND REGULATORS

ASSISTING FINANCIAL SERVICE PROVIDERS

Financial Services Providers must ensure that their organizations are truly consumer focused and are effective in proactively mitigating market place risk.

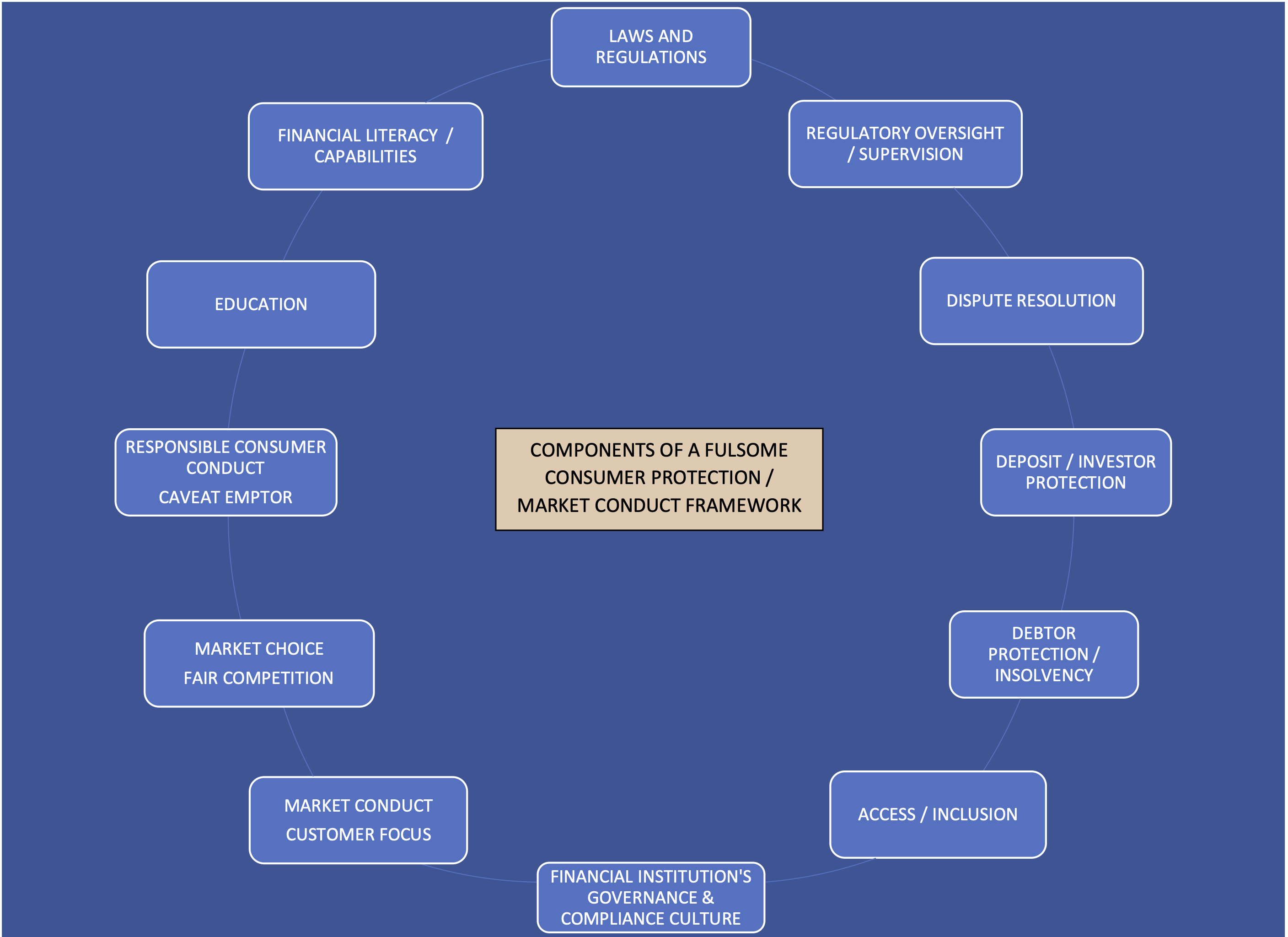

It is the clear responsibility of financial service providers and government institutions to put in place an effective consumer protection framework consisting of a number of risk mitigation components and mechanisms that will ensure financial consumers are protected from harm and provided opportunities for redress.

This includes:

- Assessing the responsiveness of financial services providers in providing effective management oversight and supervision of their market place activities and conduct.

- Assessing government institutions / regulators as to the effectiveness of the legislative, regulatory, supervisory, enforcement and educational elements of the existing consumer protection framework.

Future